Are you curious about the innovative world of crypto? Decentralized exchanges (DEXs) might be just what you’re looking for. Unlike traditional exchanges, DEXs operate without a central authority, offering a secure and direct way for kiwis to swap cryptocurrencies.

Related Guides:

How to Buy Monero in NZ – Step-by-Step Guide (2024)

What is a Decentralized Exchange (DEX)

A decentralized exchange (DEX) is a type of cryptocurrency exchange that operates on a decentralized blockchain network, rather than on a central server owned and operated by a single entity. In New Zealand, decentralized exchanges allow users to trade crypto without intermediaries or central authorities, offering users more control over their digital assets.

Unlike centralized exchanges, DEXs do not require users to deposit their funds onto the exchange’s wallet, and New Zealanders have complete control over their private keys, making them less vulnerable to hacking and other security breaches.

Some popular decentralized exchanges in New Zealand include Uniswap, PancakeSwap, and Kyber Network. These platforms offer a wide range of trading pairs and low fees, making them an attractive option for traders looking for greater privacy and security.

Best Decentralized Exchanges NZ

Type of Exchange: Decentralized Exchange

Tokens Available : 500+

Uniswap

Cryptocurrency NZ opts for Uniswap because it’s a Ethereum-based DEX that utilizes a set of smart contracts to execute trades on its platform. It operates in a decentralized manner, allowing users to trade digital assets directly from their Ethereum wallets without the need for intermediaries.

Being an open-source project, Uniswap falls within the domain of decentralized finance products, as it harnesses the power of Ethereum’s smart contract functionality.

| Pros | Cons |

| ✔️ Decentralization: Uniswap operates as a decentralized exchange, which means it doesn’t rely on a central authority or intermediary. This allows for greater transparency, security, and censorship resistance. | ❌ Network Congestion and High Fees: During times of high demand on the Ethereum network, congestion can lead to increased gas fees, making transactions costly, especially for smaller trades. This can be a limitation for users with limited budgets. |

| ✔️ User-Friendly: Uniswap offers a simple and intuitive interface, making it accessible for both experienced traders and newcomers to DeFi. Users can easily swap tokens directly from their Ethereum wallets. | ❌ Limited Scalability: Uniswap’s operations are limited to the Ethereum network, which has faced scalability challenges. As a result, users may encounter slower transaction times and higher fees during periods of network congestion. |

| ✔️ Open-Source and Community-Driven: Uniswap is an open-source project, encouraging community participation, innovation, and continuous development. It fosters collaboration and improvements within the DeFi ecosystem. | ❌ Regulatory Uncertainty: Like other DeFi platforms, Uniswap operates in a rapidly evolving regulatory landscape. Uncertainty regarding regulatory compliance and potential changes to regulations could impact its future operations and accessibility. |

| ✔️ Liquidity Provision: Uniswap’s automated market-making (AMM) model allows users to provide liquidity to the platform by depositing tokens into liquidity pools. Liquidity providers earn fees based on the trading activity in the pool. |

| Uniswap charges a 0.01%, 0.05%, 0.3% (most common), or 1% fee on swaps. These fees are paid to liquidity providers who supply tokens on the platform. |

Pros Of Uniswap Exchange

✔️ Decentralization: Uniswap operates as a decentralized exchange, which means it doesn’t rely on a central authority or intermediary. This allows for greater transparency, security, and censorship resistance.

✔️ User-Friendly: Uniswap offers a simple and intuitive interface, making it accessible for both experienced traders and newcomers to DeFi. Users can easily swap tokens directly from their Ethereum wallets.

✔️ Open-Source and Community-Driven: Uniswap is an open-source project, encouraging community participation, innovation, and continuous development. It fosters collaboration and improvements within the DeFi ecosystem.

✔️ Liquidity Provision: Uniswap’s automated market-making (AMM) model allows users to provide liquidity to the platform by depositing tokens into liquidity pools. Liquidity providers earn fees based on the trading activity in the pool.

Cons Of Uniswap Exchange

❌ Network Congestion and High Fees: During times of high demand on the Ethereum network, congestion can lead to increased gas fees, making transactions costly, especially for smaller trades. This can be a limitation for users with limited budgets.

❌ Limited Scalability: Uniswap’s operations are limited to the Ethereum network, which has faced scalability challenges. As a result, users may encounter slower transaction times and higher fees during periods of network congestion.

❌ Regulatory Uncertainty: Like other DeFi platforms, Uniswap operates in a rapidly evolving regulatory landscape. Uncertainty regarding regulatory compliance and potential changes to regulations could impact its future operations and accessibility.

| Uniswap charges a 0.01%, 0.05%, 0.3% (most common), or 1% fee on swaps. These fees are paid to liquidity providers who supply tokens on the platform. |

Type of Exchange: Decentralized Exchange

Tokens Available : 500+

Pancake Swap

Cryptocurrency chooses Pancake Swap because its a decentralized exchange built on the Binance Smart Chain (BSC).

It operates similarly to Uniswap, but on the BSC instead of the Ethereum blockchain. The DEX allows users to trade various tokens directly from their Binance Smart Chain wallets.

New Zealanders can trade tokens, provide liquidity to earn fees, and participate in yield farming by staking their tokens. Pancake swap also features various features such as decentralized token swaps, yield farming, and lottery games (play to earn games)

| Pros | Cons |

| ✔️ Lower Transaction Fees: Compared to many Eth-based DEXs, PancakeSwap operates on the Binance Smart Chain (BSC), which generally offers lower transaction fees. This makes it more cost-effective for users, especially for smaller trades. | ❌ Centralization Concerns: As PancakeSwap operates on the Binance Smart Chain, there are some concerns regarding the level of centralization compared to fully decentralized networks. BSC relies on a smaller number of validators, which raises questions about potential vulnerabilities and control. |

| ✔️ Faster Transactions: BSC’s consensus mechanism allows for faster block confirmations compared to the Ethereum network. As a result, transactions on PancakeSwap generally have quicker confirmation times, providing a smoother user experience. | ❌ Potential Security Risks: While PancakeSwap has gained popularity, it is important to consider the security risks associated with any decentralized exchange. Users should exercise caution and conduct thorough research before engaging in transactions or providing liquidity. |

| ✔️ User-Friendly Interface: PancakeSwap’s interface is designed to be user-friendly, allowing both novice and experienced traders to easily navigate and engage in token swaps, liquidity provision, and other platform functionalities. | ❌ Regulatory Uncertainty: As with any DeFi platform, regulatory frameworks surrounding PancakeSwap and BSC may evolve and introduce uncertainty. Changes in regulations could impact the platform’s operations and accessibility in certain jurisdictions. |

| ✔️ Wide Range of Token Offerings: PancakeSwap supports an extensive selection of tokens, including BSC-based projects and popular Ethereum tokens through cross-chain bridges. This broad token compatibility provides users with diverse trading options. |

PancakeSwap does not fall under the category of “no fee” exchanges, instead charging a fixed fee of 0.20% per transaction, irrespective of whether you are a maker or a taker. These fees exceed the industry average for decentralised exchanges (DEXs) as a whole.

Pros Of Pancake Swap Exchange

✔️ Lower Transaction Fees: Compared to many Eth-based DEXs, PancakeSwap operates on the Binance Smart Chain (BSC), which generally offers lower transaction fees. This makes it more cost-effective for users, especially for smaller trades.

✔️ Faster Transactions: BSC’s consensus mechanism allows for faster block confirmations compared to the Ethereum network. As a result, transactions on PancakeSwap generally have quicker confirmation times, providing a smoother user experience.

✔️ User-Friendly Interface: PancakeSwap’s interface is designed to be user-friendly, allowing both novice and experienced traders to easily navigate and engage in token swaps, liquidity provision, and other platform functionalities.

✔️ Wide Range of Token Offerings: PancakeSwap supports an extensive selection of tokens, including BSC-based projects and popular Ethereum tokens through cross-chain bridges. This broad token compatibility provides users with diverse trading options.

Cons Of Pancake Swap Exchange

❌ Centralization Concerns: As PancakeSwap operates on the Binance Smart Chain, there are some concerns regarding the level of centralization compared to fully decentralized networks. BSC relies on a smaller number of validators, which raises questions about potential vulnerabilities and control.

❌ Potential Security Risks: While PancakeSwap has gained popularity, it is important to consider the security risks associated with any decentralized exchange. Users should exercise caution and conduct thorough research before engaging in transactions or providing liquidity.

❌ Regulatory Uncertainty: As with any DeFi platform, regulatory frameworks surrounding PancakeSwap and BSC may evolve and introduce uncertainty. Changes in regulations could impact the platform’s operations and accessibility in certain jurisdictions.

PancakeSwap does not fall under the category of “no fee” exchanges, instead charging a fixed fee of 0.20% per transaction, irrespective of whether you are a maker or a taker. These fees exceed the industry average for decentralised exchanges (DEXs) as a whole.

🏆 Cryptocurrency NZ Recommendation 🏆

Type of Exchange: P2P Exchange (No KYC)

Tokens Available : 200+

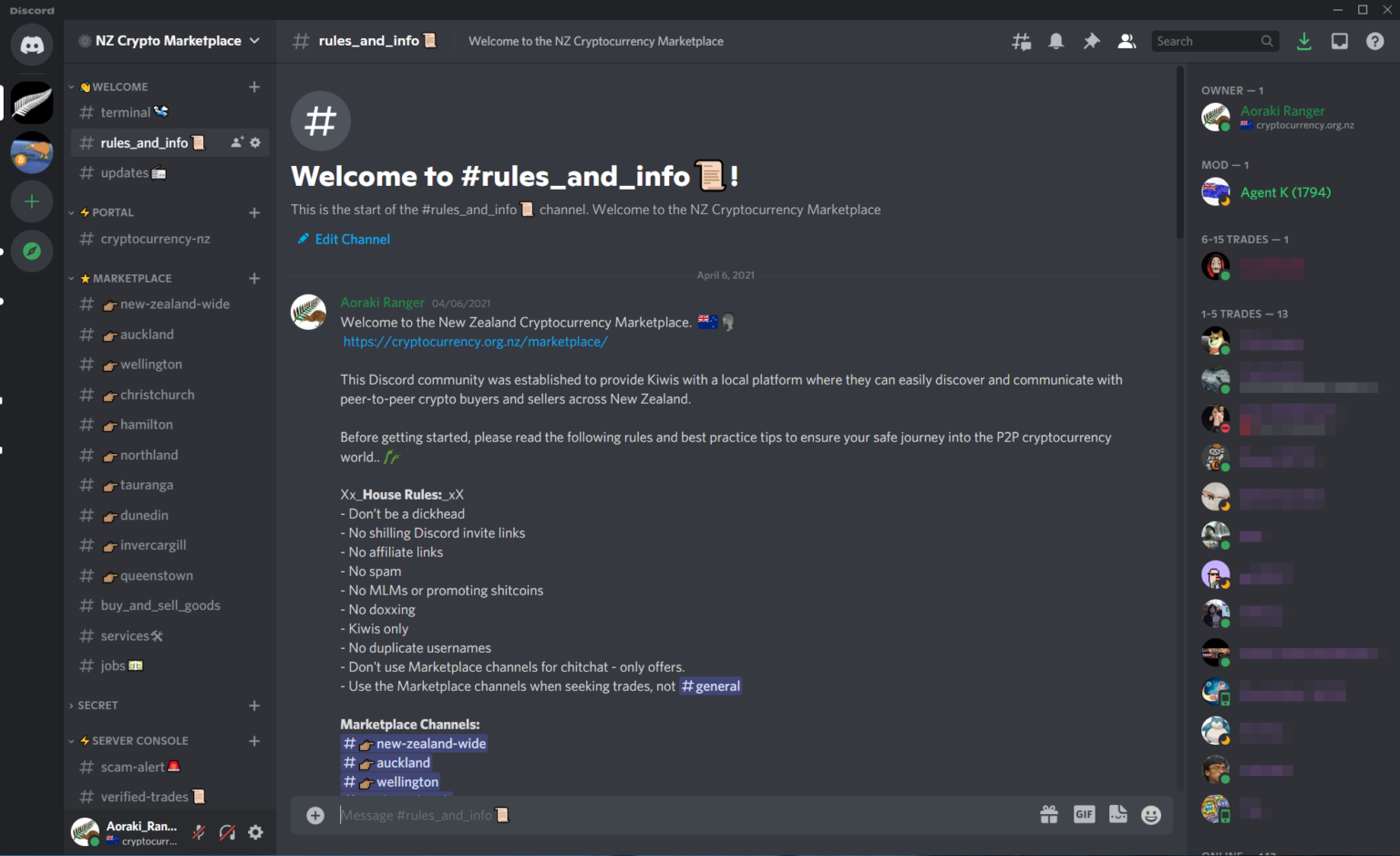

NZ P2P Crypto Marketplace

Cryptocurrency NZ opts for the Bisq Exchange due to its embodiment of decentralization and peer-to-peer trading principles. Bisq’s innovative open-source approach aligns with Cryptocurrency NZ’s vision of fostering an autonomous financial ecosystem.

Pros Of Bisq

✔️ DEX: No KYC required to begin trading, therefore provides instant approval for withdrawals

✔️ World wide: No geographical restrictions, including New Zealand.

✔️ Easy to buy: Allows kiwis to buy almost all leading cryptocurrencies, including Monero.

✔️ Wide Payment option: Various payment options are available.

Cons Of Bisq

❌ Lower Liquidity: Compared to centralised exchanges it may lack lower liquidity.

❌ Bisq fees: Trading fees are a bit on the higher side.

❌ Customer Support: Bisq has limited Customer support.

| BTC | BSQ | |

| Maker | 0.12% | 0.06% |

| Taker | 0.88% | 0.44% |

Bisq encourages traders to use BSQ by offering a discount of approximately 50%. More info can be found here.

Types of Decentralized Exchanges in NZ

Automated Market Makers (AMMs)

Automated market makers (AMMs) have gained traction as a preferred choice in the decentralized exchange landscape, in New Zealand and around the world.

The appeal lies in their ability to provide instant liquidity, offer accessible liquidity provision, and often support the creation of new markets for various tokens. AMMs essentially function as currency robots, readily quoting prices between assets. Unlike traditional order books, AMMs rely on liquidity pools where users can trade tokens, with pricing determined by algorithms based on token proportions.

AMMs address the challenge of immediate liquidity in markets that might otherwise face limitations. Unlike order book-based exchanges, which involve waiting for matches, AMMs facilitate swift liquidity access. Smart contracts define exchange rates, enabling users to access liquidity promptly. Those contributing to AMM liquidity pools earn passive income through trading fees. This unique combination of instant liquidity and open liquidity provision has given rise to the launch of numerous tokens through AMMs, serving distinct use cases like stablecoin swaps.

While AMMs are commonly used for cryptocurrencies, their potential extends to facilitating swaps involving NFTs, real-world assets, carbon credits, and more.

Multi-chain

Multichain (formerly known as Anyswap) stands out as a completely decentralized on-chain token swapping platform. Multichain empowers users within the New Zealand DeFi landscape to seamlessly exchange a diverse array of cryptocurrency tokens.

Developed on the foundation of Fusion Network architecture, the Multichain dApp facilitates the swift swapping of tokens across various blockchain networks that adopt ECDSA or EdDSA as their signature algorithm. Impressively, the Multichain platform is harmonious with more than 66 blockchains and extends support to over 2,857 tokens.

Order Book

Order books are vital tools in decentralized exchanges, showing real-time lists of buy and sell orders. These order books help match trading orders effectively.

In New Zealand’s decentralized finance (DeFi) scene, fully on-chain order book DEXs have been less common due to challenges they present. These DEXs need every order book action recorded on the blockchain. This requires high blockchain capacity or compromises in security and decentralization. Early Ethereum-based order book DEXs faced issues like limited liquidity and user experience problems. Yet, they demonstrated DEX potential.

Advancements like optimistic rollups and high-throughput blockchains have made on-chain order book exchanges more feasible, attracting trading activity. Hybrid order book models are popular too, managing orders off-chain and settling trades on-chain.

Well-known order book DEXs include 0x, dYdX, Loopring DEX, and Serum. These platforms reflect the evolution of on-chain order book trading in NZ’s fast-changing DeFi landscape.

Other Crypto Exchange Options In NZ

In addition decentralized exchanges, there are other exchange options available in NZ.

Brokerages: Cryptocurrency brokerages operate like traditional stock brokers, allowing users to buy and sell cryptocurrencies at a set price. Brokerages can be a good option for beginners who are new to cryptocurrency trading. (Easycrypto is the safest, fastest and easiest to buy Bitcoin and Ethereum)

OTC (Over-the-Counter) exchanges: OTC exchanges are designed for high-volume traders and allow users to buy and sell large amounts of cryptocurrency without affecting the market price. These exchanges typically have higher fees than other types of exchanges, but they can offer greater liquidity and flexibility.

Centralized Exchanges: A centralized exchange (CEX) is a type of cryptocurrency exchange that operates through a centralized entity or platform. In a centralized exchange, users deposit their funds and trust the exchange to facilitate transactions, maintain order books, and hold their assets. Read more about centralized exchanges.

Other Notable Decentralized Exchanges

How To Safely use DEXs in NZ

When choosing the best DEX swap for your needs, there are several factors to consider.

Liquidity: Liquidity is crucial for a DEX as it ensures better trade execution and minimizes slippage. Look for DEXs with high liquidity in the specific token.

Supported Tokens: Check if the DEX supports the tokens you want to trade. Some DEXs may have a wider selection of tokens, while others may have a more limited range.

Transaction Fees: Compare the transaction fees across different DEXs. Lower fees can significantly impact your trading costs, especially for frequent or large trades.

Security: Assess the security measures implemented by the DEX. Look for audits, bug bounty programs, and custody practices to ensure your funds are safe.

Trust and Reputation: Research the DEX’s reputation within the crypto community. Look for reviews, user feedback, and the DEX’s history of security incidents or hacks.

Community and Development: Look into the DEX’s community engagement and development activity. Active communities and regular updates indicate a thriving ecosystem and potential for ongoing improvements.

Cross-Chain Compatibility: If you require interoperability between different blockchain networks, consider DEXs that support cross-chain swaps or multi-chain functionality.

Should you Trade Cryptocurrency on DEXs?

Decentralized exchanges (DEXs) have emerged as a major player in New Zealand’s cryptocurrency trading scene. Thanks to their non-custodial nature, your funds stay safe at all times while you trade. Transactions are lightning-fast, powered by smart contracts.

Yet, it’s crucial to acknowledge that even the top-notch DEXs come with their own set of limitations. This emphasizes the need to thoroughly explore and research multiple DEXs.

Cryptocurrency NZ Final Verdict

There are numerous Decentralized exchanges in NZ to choose from, and individual traders and investors have different needs from their platform. However after exploring the options above Cryptocurrency NZ believe Uniswap and Pancakeswap take the crown.

This is why it’s critical to research the best DEX for your specific needs, because what works for one person may not work for another. Examine detailed reviews, compare the features, fees, pros and cons of each exchange. It’s better to be safe than sorry.