In the cryptocurrency space, there is an infamous saying, ‘not your keys, not your crypto‘.

This guide aims to break down the core differences between custodial and non-custodial crypto services, the risks of storing your crypto on exchanges, and how you can prevent loss of funds from crypto exchange hacks, to ensure your funds as are safe as can be.

Enjoy this guide, and never hesitate to reach out for 1-on-1 help via Crypto Consulting NZ.

What Does 'Custodial' Mean?

In the crypto realm, custodial services refer to crypto platforms or wallets that take on the responsibility of holding and managing users’ digital assets on their behalf. These include all crypto exchanges such as Binance, where funds are stored in exchange owned wallets.

A great example is Binance’s master Bitcoin (BTC) wallet, where they store over 10 billion USD worth of their user’s Bitcoin in the one single wallet – traded internally between users.

Custodial means your wallet’s private keys are held by a third party, so they have full control over your funds on your behalf. These service act as act as intermediaries, facilitating trades, payments, managing keys, and providing a user-friendly interface.

All cryptocurrency exchanges are custodial, as their systems need to have ownership and management of your crypto accounts in order to execute internal trades on your behalf.

Note: crypto exchanges are the only places where you can place real time orders with other users, and they typically offer the most features and lowest fees. Crypto retailers source their coins from exchanges, acting as the main arteries of the crypto movement.

Pros of Custodial Services:

✔️ User-Friendly Interface: Custodial platforms typically offer intuitive interfaces that make it easy for users to navigate and manage their cryptocurrency onsite holdings.

✔️ Customer Support: Users can often rely on customer support provided by the custodial service, offering assistance in case of technical issues or inquiries.

✔️ Security Measures: Custodial services implement security protocols to protect users’ funds, such as encryption, multi-factor authentication and fund surveillance.

Cons of Custodial Services:

❌Risk of Hacks: If what happened to Cryptopia or Mt Gox happens to your exchange, there is a near certainty that your funds will be affected and withdrawals will be frozen.

❌Counterparty Risk: Users face the risk of relying on a third party to secure and manage their assets. If the service encounters issues, users may be affected.

❌ Limited Control: Users have limited control over their private keys and asset management, relying on the custodian to execute orders and secure their assets.

What Does 'Non-Custodial' Mean?

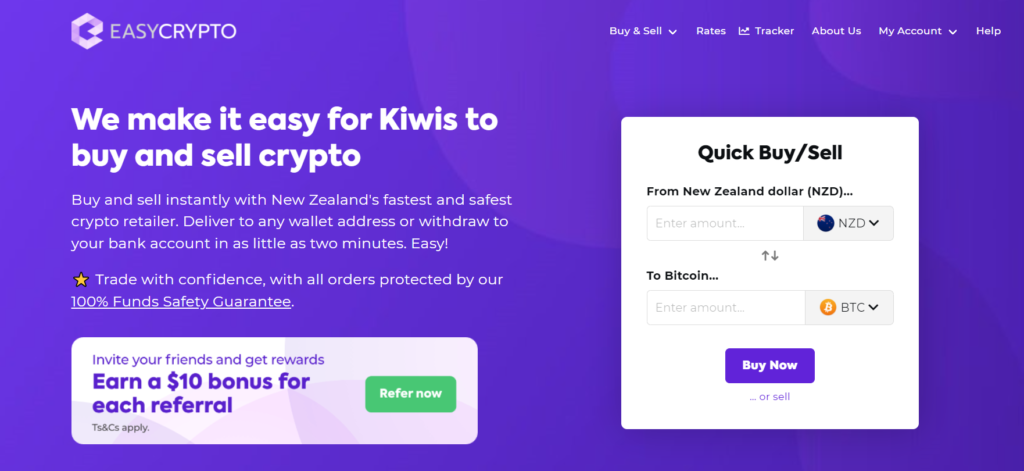

In contrast, non-custodial cryptocurrency services are platforms that have no control over your own personal holdings. A great example is Easy Crypto NZ – who is a crypto retailer opposed to an exchange – where orders are sent directly to user-owned personal wallets.

Non-custodial provide users with greater control and ownership over their digital assets, leaning more into decentralized ethos emphasizing autonomy, privacy and self-ownership.

Fundamentally, non-custodial crypto services send your crypto directly to you, and in the case they are hacked, there is no way that your personal holdings can be compromised.

Non-custodial services, such as crypto retailers, typically source their cryptocurrency from exchanges – acting as a safety buffer for users not interested in using advanced services.

Pros of Non-Custodial Services:

✔️ Enhanced Security: Users have full control over their private keys, reducing the risk associated with centralized storage. This empowers individuals to implement their own security measures and choose secure cryptocurrency storage solutions.

✔️ Full Ownership of Private Keys: Users retain complete ownership of their private keys, providing them with the ability to access their funds independently without reliance on a third party. This method is more aligned with the original ethos of Bitcoin.

Cons of Non-Custodial Services:

❌ Learning Curve: Non-custodial solutions may have a steeper learning curve, especially for individuals new to cryptocurrency. For one, they must first figure out how to set up a crypto wallet. Understanding private key management and navigating decentralized interfaces can require additional education. It must be said though that non-custodial services like Easy Crypto have an extremely beginner friendly interface.

❌ Responsibility for Security: Users bear the responsibility for securing their private keys and personal wallets. Loss or compromise of private keys can result in the irreversible loss of funds, so self responsibility is the name of the game in this regard.

❌ Limited Customer Support: Non-custodial platforms offer limited customer support compared to custodial services. This is because such services have no access to your personal wallet, so cannot provide technical support on your behalf.

Implications and Best Practice

Essentially, if you are storing crypto on a (cusdodial) exchange and it is hacked, like what happened in Christchurch with Cryptopia and with what happened to Mt Gox, your funds are at risk of being frozen and held on an exchange for many months or potentially years.

And that’s only if your funds are ever returned to you – in the case of a hack and exchange insolvency, there’s a decent chance you will never see your funds and money ever again.

This is where the ‘not your keys, not your crypto” rule comes into play. You really don’t have full ownership of your coins if you are holding them on an exchange. For this reason, we recommend only storing crypto on a exchange when you are actively trading, and keeping your funds on a personal hardware wallet when your funds are sitting dormant. This rule may sound extreme, but it is simply the most effective way to prevent any loss of funds.

Cryptocurrency NZ Final Verdict

Exchanges play a critical role in the circulation, trade and distribution of cryptocurrency. However storing all your crypto on an exchange, all the time, is simply just reckless. Many exchanges have come and gone, many have been hacked and others rug pulled. We highly recommend taking the leap into setting up your own wallet, backing it up correctly, and maintaining full ownership, self-responsibility and accountability for your own finances.