Best Bitcoin & Cryptocurrency Exchanges in NZ

The safest, fastest, and easiest way to buy Bitcoin, Ethereum and other cryptocurrency in New Zealand is through a Kiwi crypto retailer like Easy Crypto NZ or Binance.

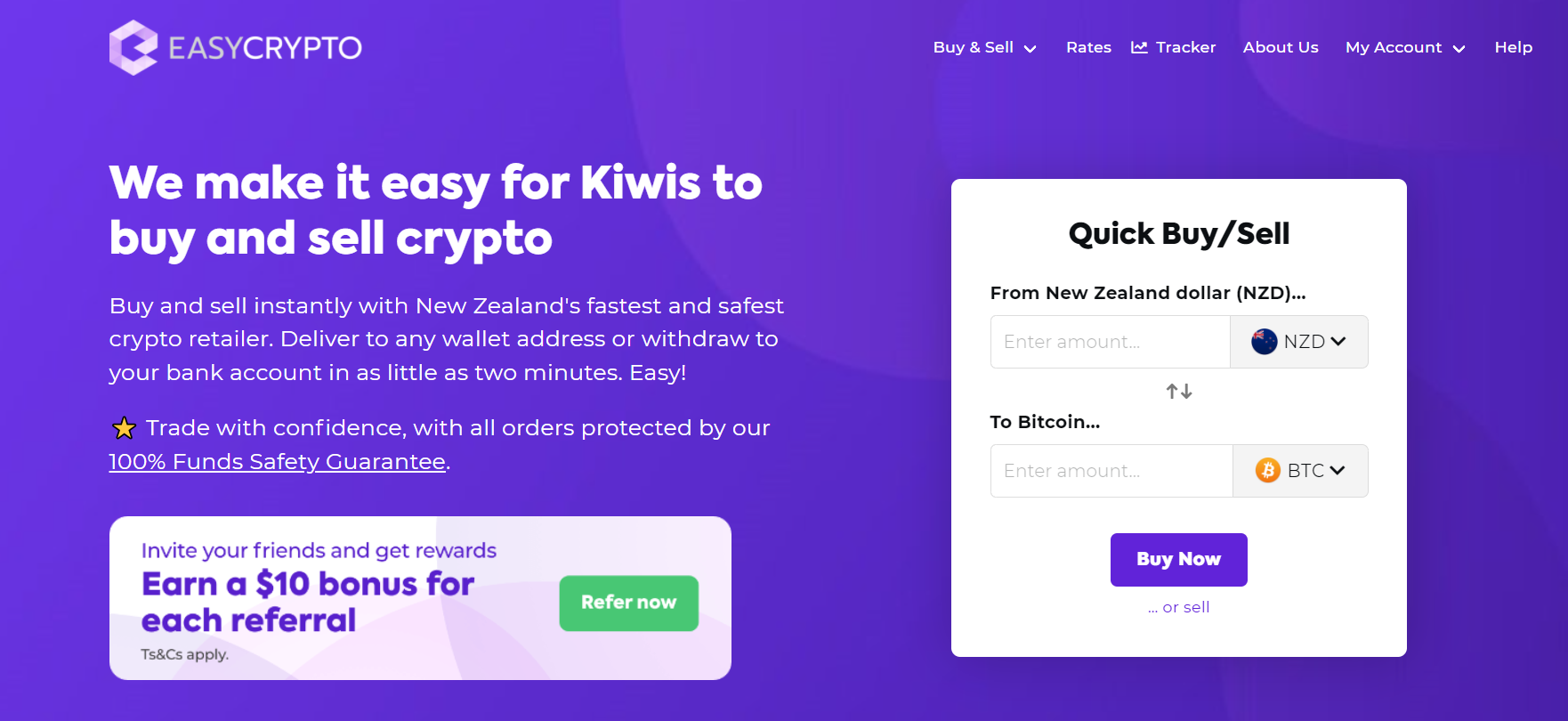

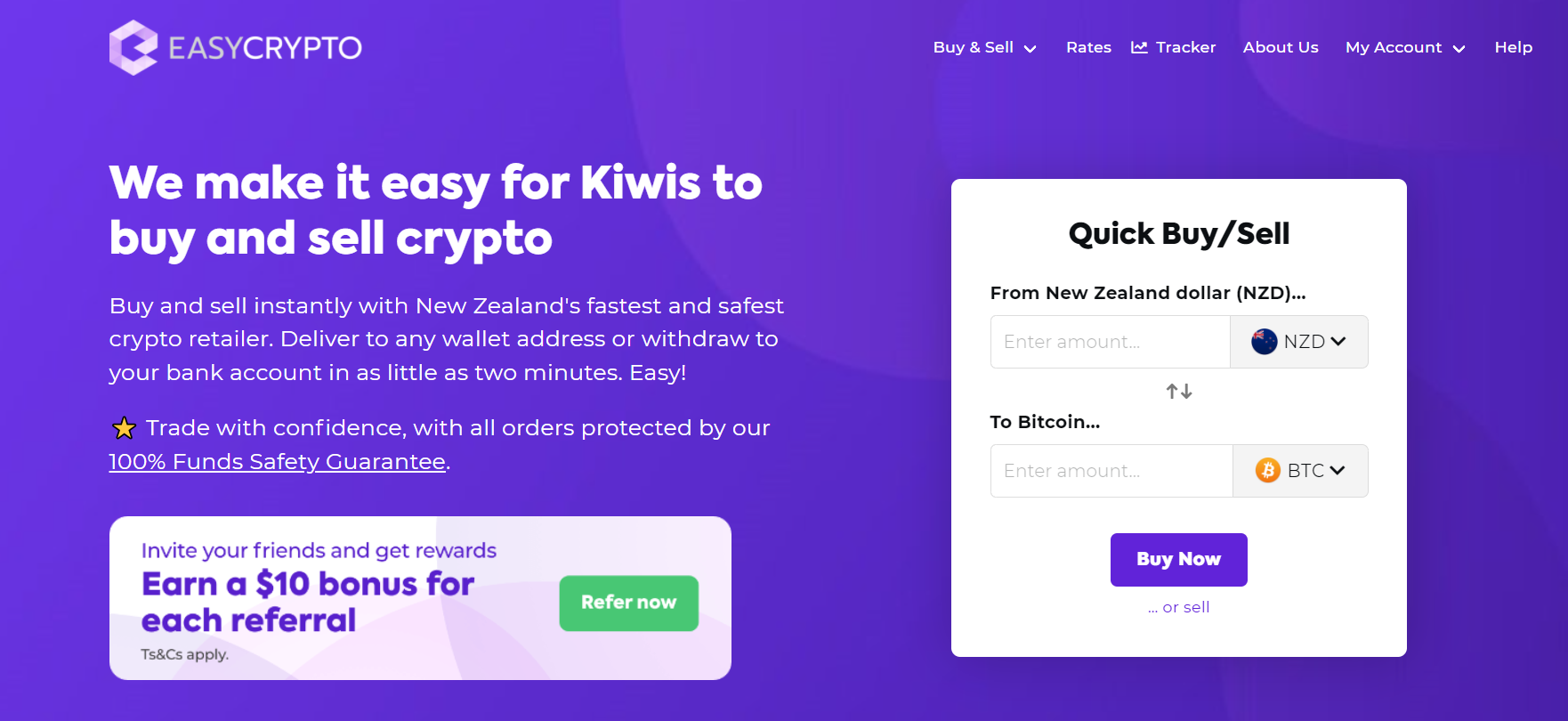

NZ’s Most Popular Retailer

- Instant NZD deposits & withdrawals

- 100+ cryptocurrencies available

- Excellent NZ-based customer support

Recommended for beginners

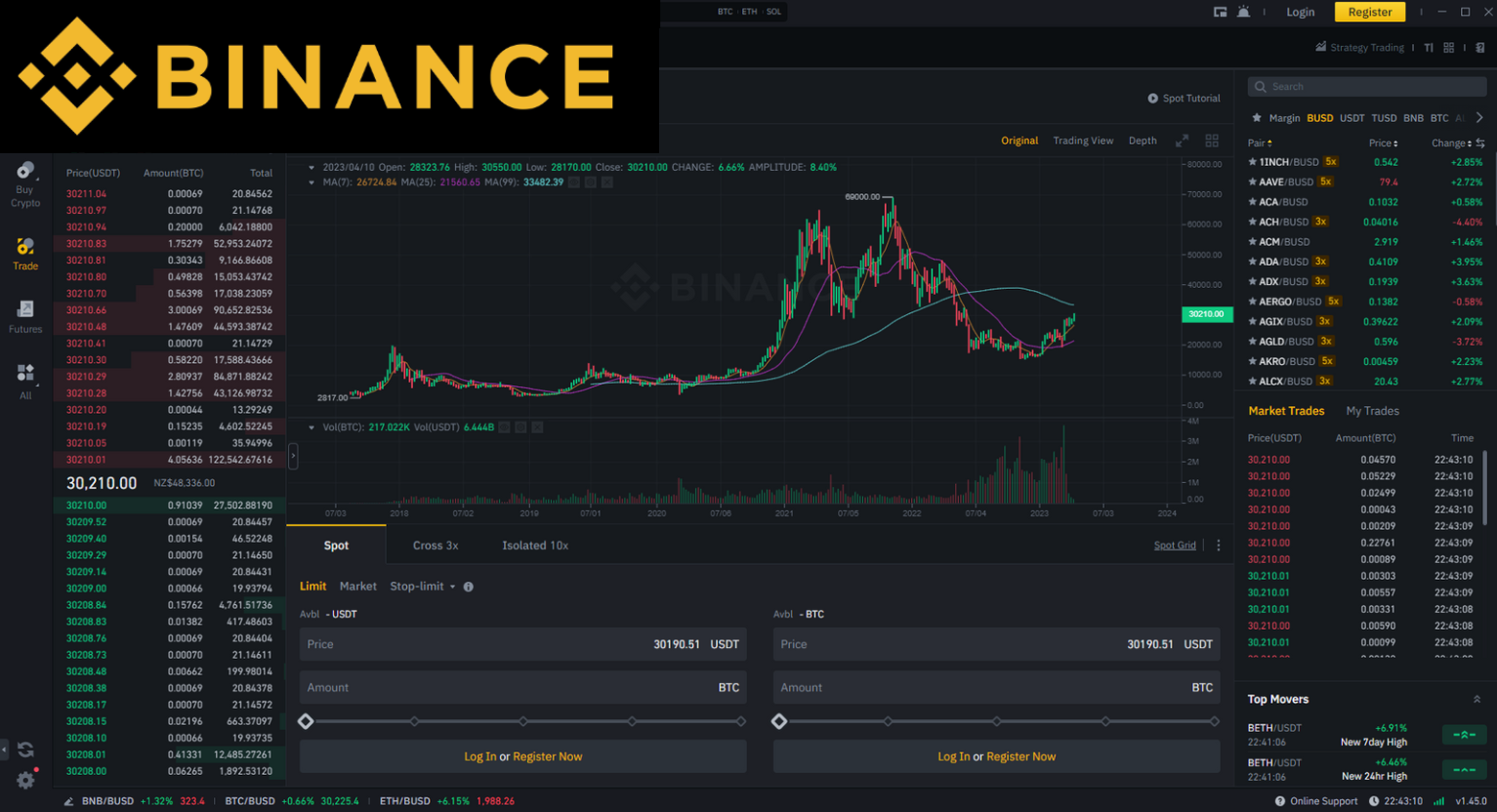

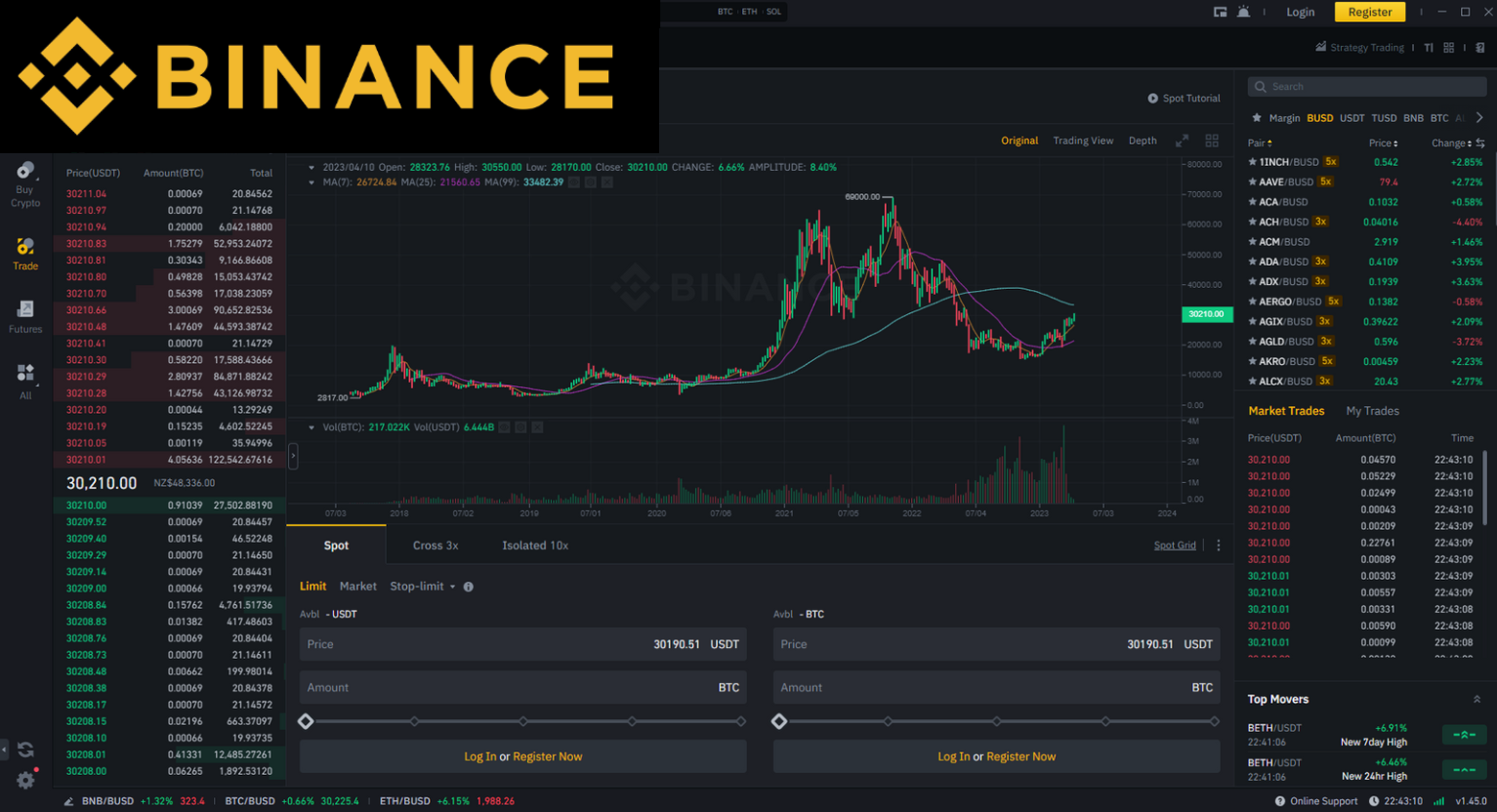

The World’s Biggest Exchange

- World's largest crypto exchange

- Advanced trading tools & features

- 350+ cryptocurrencies available

Best for experienced traders

Cryptocurrency exchanges are one of the best ways to buy, sell and trade crypto in NZ. Popular currencies that Kiwis buy, sell and trade include Bitcoin, Ethereum and Dogecoin.

There are over 200 exchanges in the world to choose from and Cryptocurrency NZ combed through the leading players to determine the best crypto exchanges in NZ.

Best Cryptocurrency Exchanges in NZ

Easy Crypto NZ

Best for Beginners

Easy Crypto NZ is New Zealand's most popular crypto retailer, making it safe and fast for Kiwis to buy and sell over 110+ cryptocurrencies including Bitcoin, Ethereum, Monero, Dogecoin & XRP.

Visit Easy Crypto NZOur ReviewMEXC Exchange

Best for NO-KYC Trading

MEXC is a leading global crypto exchange offering Kiwis access to 1,000+ cryptocurrencies with low fees, high liquidity, and no mandatory KYC in New Zealand. Trade Bitcoin, Ethereum, and more with full control.

Visit MEXC ExchangeOur ReviewBinance NZ

Best for Advanced Traders

Binance, the world's largest crypto exchange, is a popular platform for Kiwis with over 1400 trading pairs and some of the lowest fees in the industry.

Visit Binance NZOur ReviewKuCoin Exchange

Best for Altcoin Access & Advanced Traders

KuCoin is a global exchange known for its massive range of altcoins, advanced trading features, and passive income tools like staking and lending. While not NZ-based, it's open to Kiwi users and doesn't require mandatory KYC for basic functionality.

Visit KuCoin ExchangeOKX Exchange

Best for Advanced DeFi & Derivatives Trading

OKX is one of the most sophisticated global exchanges available today, offering Kiwi users powerful tools for spot, futures, options, and DeFi trading. It's best suited for experienced users but still accessible to beginners who are willing to learn.

Visit OKX ExchangeOur ReviewLocalcoin

Best for NZ-Based Peer-to-Peer Trading

Localcoin is a Canadian-founded company now operating Bitcoin ATMs across New Zealand. These machines let users buy or sell Bitcoin using physical cash no bank required. It's one of the few ways to access crypto directly with NZD cash, making it a niche but useful option for those who value speed and accessibility.

Visit LocalcoinOur ReviewNeed more help deciding? Contact us for personalized advice →

What is a Cryptocurrency Exchange In NZ?

Cryptocurrency Exchanges in New Zealand

Crypto exchanges serves as a dedicated marketplace in New Zealand where individuals can seamlessly trade a variety of cryptocurrencies, including popular options like Bitcoin, Ether, or Dogecoin. These platforms operate much like other trading platforms you may already be familiar with, making it easy for you to participate in the dynamic world of cryptocurrency.

Cryptocurrency exchanges may also offer additional advanced trading features, though the availability of such features can vary. For instance, some exchanges support margin accounts and futures trading, while others may provide opportunities for cryptocurrency staking or loans. These unique features can empower you to potentially earn interest on your crypto holdings or explore more complex trading strategies.

How Do Crypto Exchanges Work in New Zealand?

Crypto exchanges in New Zealand operate as digital platforms where users can engage in various transactions involving cryptocurrencies. Much like brokerage platforms in the traditional financial world, these exchanges provide a user-friendly interface that enables individuals to place different types of orders to buy, sell, or speculate on various cryptocurrencies in collaboration with other users.

Centralized Crypto Exchanges: Centralized exchanges, often managed by a single corporate authority, function as intermediaries that facilitate secure cryptocurrency trading. These platforms are akin to brokerage companies, offering a structured environment for users to trade.

Decentralized Crypto Exchanges: On the other hand, decentralized exchanges follow a different model. They distribute verification and transaction certification powers to any participant who wishes to join the network. This approach closely aligns with the principles of cryptocurrency blockchains, enhancing accountability and transparency within the exchange system.

Types of Cryptocurrency Exchanges In NZ

Centralized Exchange (CEX): In New Zealand, the most popular method for buying, selling, and trading digital assets like Bitcoin, Ethereum, and Litecoin is through centralized crypto exchanges (CEX). These crypto exchanges, such as Gate.io Bybit, and Binance, are owned and operated by private companies and have gained widespread adoption due to their user-friendly interfaces and extensive cryptocurrency offerings.

One essential aspect is that centralized exchanges in NZ adhere to regulatory requirements, particularly the Know Your Customer guidelines. As per these regulations, users are required to register and provide their identity, which assists in combating money laundering and preventing other illicit activities.

Decentralized Exchange (DEX): A decentralized exchange (DEX) is a type of crypto exchange that operates on a decentralized blockchain network instead of a central server. DEXs enable users to trade cryptocurrencies without intermediaries, providing more control to traders. Unlike centralized exchanges, DEXs don't require users to deposit funds into the exchange's wallet, and users maintain complete control over their private keys, enhancing security and reducing vulnerability to hacking.

Some popular decentralized exchanges in New Zealand include Uniswap, PancakeSwap, and Kyber Network. These platforms offer a wide range of trading pairs and low fees, making them an attractive option for traders looking for greater privacy and security.

Cryptocurrency Exchange Fees

Trading Fees: Trading fees can take different forms, such as a fixed percentage of your cryptocurrency transaction's value or varying rates for maker and taker orders, each responsible for either adding or removing liquidity from the exchange. Generally, maker fees are slightly lower.

While seeking an exchange with low costs is wise, getting bogged down in the intricacies of maker and taker fees can be counterproductive. This is because you don't control whether your order is treated as a maker or taker. Instead, it's more beneficial to consider overall fees and potential discounts based on your trading volume or holding the exchange's native token.

Important! It's crucial to note that some cryptocurrency exchanges claim zero fees, but they may apply spreads, essentially the difference between their buying and selling rates. Spreads can, and often do, end up being more expensive than a percentage-based trading fee.

Withdrawal Fees: Many cryptocurrency exchanges charge fees for withdrawing coins. If you plan to move your crypto to a secure wallet or another exchange, opt for platforms offering fee-free withdrawals.

Additional Fees: Engaging in advanced trading strategies like margin trading may incur extra borrowing fees. User-friendly exchanges often feature quick buy options with slightly higher fees, which can be avoided by learning to trade on the platform.

Centralized Exchange Features

Order Books: The order book constitutes a fundamental element in the structure of a centralized exchange. Its primary purpose is to facilitate trading activities for customers. Essentially, the order book functions as a comprehensive ledger documenting buy and sell requests from traders for a specific asset pair. This system typically comprises a sell-side and buy-side, with prices denoted relative to the base currency.

In the standard order book framework, orders are systematically organized based on their price levels, with specific prices being computed and displayed in the book. Sell orders are positioned in ascending order, starting from the lowest asking price, while buy orders are arranged in descending order, commencing with the highest bid.

Fiat On-Ramp/Off-Ramp: Acquiring cryptocurrency with fiat money is streamlined by centralized exchanges, thanks to fiat on-ramp services. These services empower New Zealanders to buy cryptocurrencies using funds from their conventional banks such as Kiwibank or ANZ, often involving a third-party financial service provider to execute purchase requests on behalf of both the exchange and the customer.

It's important to note that when it comes to converting cryptocurrency back to New Zealand Dollars (NZD), the options for off-ramping may be limited, with only a few platforms available, including Easy Crypto NZ, Binance NZ, and Pay it Now (PIN).

KYC Requirement: Centralized exchanges implement KYC (Know-Your-Customer) protocols as a distinctive customer profiling process. This procedure serves as the exchange's means of verifying a customer's identity and confirming their authenticity. KYC aims to thwart illicit activities.

Typically, KYC procedures entail the submission of personal information, including national identity cards, facial identification, and registered phone numbers. While these measures enhance security, it is crucial to acknowledge that the imposition of KYC does compromise the inherent anonymity and ethos of cryptocurrencies, which are designed to operate on a decentralized and pseudonymous basis.

Other Crypto Exchange Options In NZ

In addition to centralized and decentralized exchanges, there are other cryptocurrency exchange options available to users in NZ:

Peer-to-peer (P2P): P2P platforms allow users to buy and sell cryptocurrencies directly with each other, without the need for a central authority or intermediary. These platforms can offer users more privacy and flexibility, but they may have lower liquidity and higher transaction fees than centralized exchanges. (NZ's own P2P marketplace)

Brokerages: Cryptocurrency brokerages operate like traditional stock brokers, allowing users to buy and sell cryptocurrencies at a set price. Brokerages can be a good option for beginners who are new to cryptocurrency trading. (Easycrypto is the safest and fastest)

OTC (Over-the-Counter) exchanges: OTC exchanges are designed for high-volume traders and allow users to buy and sell large amounts of crypto without affecting the market price. These exchanges typically have higher fees than other types of exchanges, but they can offer greater liquidity and flexibility.

How to Pick the Best Cryptocurrency Exchange in NZ

When determining the best cryptocurrency exchange for your needs, it goes beyond just fees. Take into account the following factors:

- Supported Assets: Confirm that the exchange supports the specific asset you intend to trade.

- Region Supported: Explore exchanges with a strong presence in NZ.

- Security: Evaluate the exchange's security measures to safeguard both funds and user profiles.

- Proof of Reserves: Check if the exchange has implemented a Proof of Reserves (PoR) feature.

- Trading Volume: Assess the trading volume on the exchange as an indicator of activity and liquidity.

- Fees: Scrutinize the fees charged by the exchange for both trading and withdrawals.

- Trading Features: Evaluate the range of trading services offered by the exchange.

Selling Crypto in NZ Commonly Asked Questions

Yes – you can sell cryptocurrency in NZ in minutes through one of New Zealand's various crypto retailers or exchanges, such as Easy Crypto NZ.

Crypto wallets are digital vaults where you store your Bitcoin, Ethereum and other digital assets – acting in a similar way to your NZ bank account.

There are 5 main types of cryptocurrency wallet, such as Hardware wallets like the Trezor and Ledger or software wallets like Exodus.

Learn about your best options in our Best Bitcoin, Ethereum & Crypto Wallets in New Zealand Guide.

New Zealand anti-money laundering laws (AML) require all Kiwis to verify their identities before they can buy and sell cryptocurrency through regulated NZ crypto trading platforms, such as Easy Crypto NZ or Binance.

Alternatives to using regulated services to acquire crypto include crypto mining, buying P2P, airdrops, Crypto ATMs, and decentralized exchanges. You can also get crypto by accepting it as payment for the goods and services you sell, or doing work in exchange for crypto.

To verify an account with an NZ exchange, you need to:

- Be 18 years or above.

- Have a valid NZ passport or drivers license.

- Have an NZ bank account under your own name.

- Have $50 to meet minimum order requirements.

It typically takes less than a day to sell Bitcoin, Ethereum and other crypto in NZ – depending on your service of choice. It's possible to sign up with an NZ crypto exchange or retailer like Easy Crypto NZ, verify your account, sell crypto and have it delivered to your personal bank account within a day.

Crypto Selling speeds vary in three key ways:

- Account creation and verification speeds; the time it takes from signing up with your chosen service to them confirming your identity. (To allow you to buy/sell/exchange)

- Order creation and delivery speeds; how long it takes to create, send the crypto and complete your order - and how long it takes for your chosen service to dispatch your fiat to your bank account.

- Network processing speeds; how fast crypto transactions are processed by the crypto networks. (This is not in the control of your chosen service)

The charges for selling bitcoin vary based on the payment method and platform utilized.

For instance, if you’re selling to a friend and completing the transaction with cash, you’ll only have to account for the ‘network fee’ for transferring the bitcoin from your digital wallet to theirs.

If you’re receiving payment via bank transfer, you’ll need to include the applicable fees.

Additionally, exchange services impose fees for managing trades, which encompass operational expenses and a slight markup.

Ready to start your crypto journey? View all NZ exchanges →