Bitcoin / Crypto Debit Cards NZ - NZ Crypto Guide

Enter cryptocurrency debit cards - the cards that let you spend Bitcoin and other crypto at almost any place in NZ where you can buy things with NZD. Welcome, to the future.

Have you ever wondered if it’s possible to live off cryptocurrency and use it as your day-to-day money in New Zealand? If you have and thought it’s impossible, you wouldn’t be alone.

Until 2020, most Kiwis believed that New Zealand businesses must accept crypto as a payment method before people like us can buy things from them with Bitcoin and other digital currencies. On top of this, there are only an estimated 350 businesses directly accepting cryptocurrencies like Bitcoin and Ethereum as payment in New Zealand.

Well, what if I told you it doesn’t matter, and businesses don’t actually need to ‘accept crypto’ for you to buy goods and services from them with cryptocurrency in NZ?

How? I introduce you to the next generation of cards; multi-currency, international / NZ cryptocurrency debit cards – allowing you to spend Bitcoin and crypto almost anywhere.

TLDR: The best, most reliable, and fastest crypto cards in NZ are Wirex and Crypto.com.

Prefer to see all available options?

What is a NZ Cryptocurrency Debit Card?

A cryptocurrency debit card is a pre-paid card that connects to your crypto wallet, or has it's own dedicated wallet, which allows you to spend and buy things with your crypto at almost any place where you can buy things using your standard Visa or Mastercard card.

The way they work is simple. You pre-load your favorite cryptos onto your chosen card (such as Wirex or Crypto.com). And when you buy something, your card automatically converts your crypto into the local currency and completes your purchase using NZD.

Your recipient is receiving NZD and you're paying with crypto – and your card is taking care of the hard work for you. In fact, the recipient doesn't even know you're paying with crypto in the first place. 😎 They're reliable, trusted, and make spending crypto in NZ easy.

Cryptocurrency cards like Wirex or crypto.com work by piggy backing off existing payment gateway infrastructure such as the Visa, Mastercard, and Stripe payment terminals that you use on a daily basis when you buy things from almost any business in New Zealand.

This also means you can easily take your crypto card with you overseas, and it will still work when spending crypto on international goods and services in other countries.

The only place my Wirex cryptocurrency debit card has failed me is at the odd fish & chip shop when they're not accepting international cards. Otherwise, I had 100% cryptocurrency card reliability for 6 months straight over my experience with living on crypto in NZ (2020).

How to Get a Cryptocurrency Card in NZ

Crypto cards are famously easy to obtain, thanks to companies like Wirex shipping them directly to your home address for free. They take about a week to ship, and as soon as you receive your card, you can start using it to spend your crypto instead of relying on NZD.

Here in New Zealand, most Kiwis go with one of two crypto cards, Wirex & Crypto.com

Order your own crypto card today to unshackle you from your bank, have an fail safe to your NZD cards and help you unleash the true power of decentralized currency in action.

Cryptocurrency Debit Card options in NZ

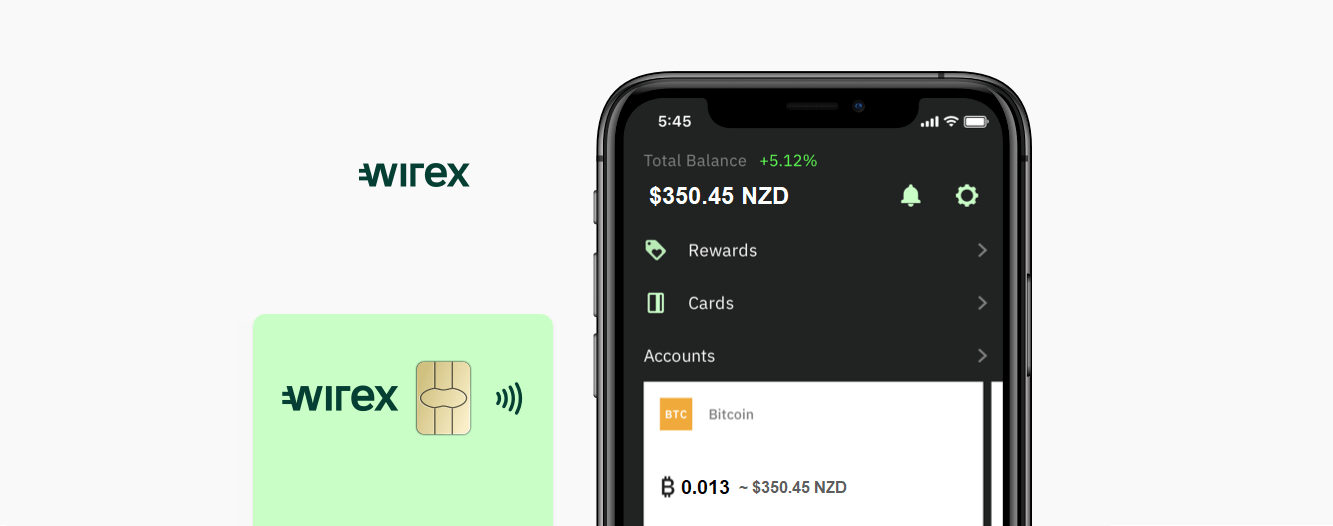

Wirex Card

Buy, Trade and Grow your Money

- Earn up to 8% on every card transaction.

- No ATM and FX fees Up to $200 fee free ATM withdrawals globally

- Trusted by 6 million people since 2014 with 20 billion in transactions.

Wirex is one of the world's most popular crypto cards, serving over 3 million users in over 130 countries worldwide, including New Zealand.

Wirex is easily one of the best crypto cards in NZ. This is largely because it has zero transaction or account maintenance fees. Wirex is also extremely reliable and has a highly intuitive mobile app for managing accounts and transferring funds.

When you spend with Wirex in-store, you also receive up to 1.5% cash back for all purchases in WXT, and the range of other cryptos supported by Wirex.

This means if you buy a $5,000 car with your Wirex card, you can receive back up to $75 NZD in WXT deposited directly into your Wirex wallet. (Wirex cashback for more details)

Visit wirexapp.comCrypto.com Card

The only Crypto Card you need

- Earn up to 5% of CRO Rewards.

- No ATM and FX fees Up to $1000 USD fee free ATM withdrawals.

- Trusted by 20 million people since 2016 with 50 billion in transactions.

The Crypto.com card (formally known as Monaco) is a highly popular pre-paid crypto debit card, best known for its durable composite metal cards , tiered cashback system, and rebate rewards. Crypto.com are one of the most recognized cryptocurrency companies in the space, known best for their expansive crypto eco-system and sponsoring the UFC.

Crypto.com's card is definitely more advanced than Wirex – supporting over 50+ coins while providing users with a range of cards that vary in benefits depending on how much CRO (Crypto.com's native token) you stake – ranging from $0 tp $400,000 USD stake.

Visit Crypto.comNeed more help deciding? Contact us for personalized advice →

Wirex vs Crypto.com – Crypto Debit Card Comparison

Because both cards offer near-zero fees, the difference between Wirex and Crypto.com is the benefits you can receive for staking various amounts of each platform's native tokens. (CRO & WRX) Wirex's staking program isn't something you need to engage with to use Wirex's card, and could be seen as 'additional content' Whereas with Crypto.com, you're required to stake CRO, even to order a card in the first place. The benefit to this, however, is that users receive better rewards for spending crypto with crypto.com in New Zealand.

Cryptocurrency Debit Card Comparison

Visit wirexapp.com

Visit wirexapp.comRewards

- Up to 1.5% cashback

- Learn more

Fees

- Card delivery: Free

- Issuance fees: $0

- Account fees: $0

- Card fees: $0

- NZD deposits: $0

- Crypto deposits: 1%

Supported Coins

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Dai (DAI)

- Stellar (XLM)

- Wirex Token (WRX)

- and more...

Order Here

Order HereRewards

- Up to 8% cashback

- 100% Spotify rebate

- 100% Netflix rebate

- 100% Prime rebate

- 10% Expedia rebate

- 10% Airbnb rebate

- Learn more

Fees

- Card delivery: Free

- Issuance fees: $0

- Account fees: $0

- Card fees: $0

Supported Coins

- Bitcoin (BTC)

- Ethereum (ETH)

- TrueUSD (TUSD)

- EOS (EOS)

- Paxos (PAX)

- Litecoin (LTC)

- Ripple (XRP)

- and more...

Cryptocurrency Debit Card Summary

Cryptocurrency cards enhance your financial life in many ways. They give you an international bank account, let you spend crypto like you would NZD, and give you more financial freedom to use and spend your money how you like. They also work overseas.

In a world where crypto is yet to be accepted as a mainstream payment method, the role of crypto debit cards is to bridge the gap between the old world and the new. However it is to be said they are still an intermediary, and must not be confused with P2P, which is the intention of Bitcoin’s purpose – to be used P2P without a middleman like a crypto card.

Wirex and Crypto.com offer reliable, secure, and usable Bitcoin and crypto debit cards, which are entirely capable of helping you live off crypto. The key difference between each platform is their staking and rewards system, which could be seen as overkill or beneficial, depending on what exactly you’re wanting from your crypto card in New Zealand.

It’s also guaranteed other crypto cards will arrive in NZ, or are even being built here, which may soon be better suited to your needs. We will update this guide when the happens.

After researching and trialing both cards, Cryptocurrency NZ prefers Wirex due to its simplicity, ease of use, and reliability. For me, the benefits of Wirex far outweigh their negatives, notably in customer support and ticket response times, and sketchy ratings.

Crypto.com, on the other hand, is more advanced, has better rewards, supports more coins, and is better suited to those wanting to maximize spending perks – best suited to high spenders and those invested in the Crypto.com ecosystem / cinematic universe.

I hope this guide has provided you with value in one way or another, and don’t hesitate to leave a comment below to give feedback or ask any questions.

Disclaimer: All content in this guide is intended for educational purposes only and should not be interpreted as financial advice. As an individual, you are entirely responsible for how you conduct your investments and manage your cryptocurrency interests. It is exclusively your own responsibility to perform due diligence and Cryptocurrency NZ recommends taking extreme care and caution with crypto and are not responsible for the outcomes, management, or oversight of your activities.